Tuesday, December 18, 2018

Beware of this possible Wechat Scam, stock drop 70% in a day - Andy Yew ...

Andy Yew sharing on recent penny stock crash, could be link to some wechat scam that is going on recently. Right now there are some stock that is under restrictive trade, meaning you cannot buy online yourself. (Have to go thru broker)

Wednesday, December 12, 2018

PENNY STOCK投资仙股容易赚钱吗? Andy Yew Vlog Ep 8

Andy Yew 游俊昌 - Cityplus FM interview with DJ Yoga - Part 3 - Final

不要听故事去买股,因为那是写故事的人的目的。(就是要你买)

股票能赚钱吗?新手怎么能在股市提高赚钱的机会? Andy Yew Vlog Ep 7

视频内容:

Andy Yew (游俊昌)Cityplus 电台分享如何通过投资股票赚钱?

很多人好奇,真的可以通过投资股票赚钱吗?答案是: 可以。每一位世界首富都有一个共同点: 一间代表着他们身份的公司 - 通过融资从股市里赚钱,其身价也随着股价上涨而飙升。同样的道理, 股民也可以通过投资这些公司的股票以增值自己的财富!

如何才能在股票市场上赚钱?

- 了解现在的趋势并投资上升趋势的股票。(如:食品股)

- 避免短期投资 (理想持有期为3个月)

- 能自立地筛选和决定要投资的股票。

如何避开亏损 /入套?

- 适时需要割肉止损,避免抄底。

- 筛选股票的过程中不能只取决于新闻或道听途说的“故事”。

想了解如何用ART系统找出高概率的潜力股吗?

可以到www.winbigtrend.com/chinese 看看我们的WEBINAR

Labels:

Media Interview

Tencent Holdings 0700.HK

Hong Kong Stock Tencent Holdings (0700.HK) was down since Mar 2018, recently price begin to turn around and the system manages to catch the rebound with blue bar arrow....

Business Summary

Tencent Holdings Limited is an investment holding company principally involved in the provision of value-added services (VAS) and online advertising services. The Company operates through three main segments. The VAS segment is mainly involved in provision of online/mobile games, community value-added services and applications across various Internet and mobile platforms. The Online Advertising segment is mainly engaged in display based and performance based advertisements. The Others segment is mainly involved in provision of payment related services, cloud services and other services. Tencent also own Wechat, one of the popular chatting platform with multiple functions.Tuesday, December 11, 2018

Galaxy Entertainment ( 0027.HK )

Hong Kong Stock Galaxy Entertainment (0027.HK) was down since May 2018, recently price begin to turn around and the system manages to catch the rebound with blue bar arrow....

Saturday, December 8, 2018

2019 会是熊市吗?熊市应该怎么办?哪一些股票要小心? Andy Vlog Ep 6

2019年会是熊市吗?相信大家心中都有这个疑问。

Andy Yew 游俊昌 - Cityplus FM interview

继2008年的股灾之后,美国股市处于牛市已长达10年之久,可是最近全球经济开始出现衰退的现象。

答案是:可能性非常大!

在2018年,道琼斯指数表现地跟过去几年不一样, 它出现了横盘的状态,即没有跌破也没有突破, 漂浮在24000-26600点之间牛市尾声的征兆。如果2019年道琼斯指数跌破24000点(6个月的新低)或23500点(1年低点),那就代表着熊市即将来临。

大家心里也会问:熊市是最好进场的时机吗?

答案:当然! 但必须等待熊市结束后才趁低吸纳。(熊市几时结束?当它不再创新低)

亚太股市市场

其实在2018年,香港和中国已经进入熊市,两国的指数已跌破20% ,各股(如:腾讯)也已跌超过40%。但大家需要明白,熊市不会导致股市跌到90% (例如:2008年股灾只跌了50%)。所以当股市已跌20 + % 时,其实已经是熊市的尾声。大家需要做的是,注意其经济是否有反弹/复苏的现象,并在危机里寻找转机。当然,大家需要小心筛选,并不是全部的股票都会在股灾后反弹,原因可能是它们处于下跌趋势的板块(例如:报社/报馆) 。

看下一集:如何在股市中找到大赢家(潜力股)

想了解如何用ART系统找出高概率的潜力股吗?

可以到www.winbigtrend.com/chinese 看看我们的WEBINAR

Is market going to crash in year 2019? I believe everyone has this question in mind.

After the 2008 stock market crash, the US stock market has been in the bull market for 10 years. However, the global economy has recently begun to decline.

My answer is: the possibility is very HIGH!

If the Dow Jones index falls below 24,000 (6-month low) or 23,500 (1 year low) in 2019, it means the bear market is coming.

03 Jan 2019

Dow Jones Average - 22686.22

Remember? Our investment method is Trend Following.

Then everyone will ask: Is it a good time to enter during bear market?

Answer: Of course! But you must wait for the bear market to end before buying back(buy @ discounted price).

(When does the bear market end? When it stop to drop / create new low)

And what should we do before the end of the bear market?

The answer is: Use CFD to sell short!

How to sell short a stock with a stoploss, please refer to the following video:

Labels:

Media Interview

Monday, November 12, 2018

How to Short US or Singapore stock and Set a Stoploss on Poems

Market has been falling, short selling is probably the way if you still want to stay in the market, using the Singapore most popular trading Apps - Poems Mobile 2.0.

My favorite 2 method of shorting

Number 1 is to Short Sell when the TREND change, this is usually when the stock is up and rising for a few months and after a long ride up the trend became weak and start to TURN DOWN. Usually it is sideway for about 2-3 week, if we see the price fall further it means it is weak.

This is an chart of SouthWest Airline (LUV) which I posted on our Fanpage www.facebook.com/winbigtrend , like our facebook fanpage now if you haven't, to get the latest update.

For the Second Strategy on Short Selling, it is on a shorter term time frame, since i have made a video few days ago, I would like to invite you to watch the video for better illustration

Subscribe my Youtube Channel here www.youtube.com/AndyYew

My favorite 2 method of shorting

Number 1 is to Short Sell when the TREND change, this is usually when the stock is up and rising for a few months and after a long ride up the trend became weak and start to TURN DOWN. Usually it is sideway for about 2-3 week, if we see the price fall further it means it is weak.

This is an chart of SouthWest Airline (LUV) which I posted on our Fanpage www.facebook.com/winbigtrend , like our facebook fanpage now if you haven't, to get the latest update.

This is the mid term CFD Short selling Strategy, so we have to let the trend run when we are on the right Direction. So what happen is after about 4 weeks LUV dropped 22%.

Subscribe my Youtube Channel here www.youtube.com/AndyYew

Labels:

CFD,

Short and Hedge

Thursday, November 1, 2018

Tuesday, October 16, 2018

Singapore Company Results: The earnings seasons for Q3 2018 is here !

Many people is asking when is the Quarterly Results coming out for VENTURE, M1, SIA, UOB, OCBC & etc...

The earnings seasons for Q3 2018 is here, below are the Singapore stock corporate earnings calendar :

Click for our latest FREE 30-hours investment seminars

The earnings seasons for Q3 2018 is here, below are the Singapore stock corporate earnings calendar :

Click for our latest FREE 30-hours investment seminars

Monday, October 8, 2018

SouthWest Airline (LUV) is available for Shorting in CFD

CFD Bearish Stock Spotted - SouthWest Airline (LUV) When US market is strong, he go sideway. This stock seems to be cyclical now system show red signal sell signal. Will it have a sharp drop?

example of a trade setup will be Stoploss at 64, Target 54

example of a trade setup will be Stoploss at 64, Target 54

Labels:

CFD

Gamuda - Downtrend since RM5.00. Recently our trading System show exit signal at RM3.60 again and Smart money is missing since then.

If you stick to uptrend stock, you will be able to avoid this counter

If you cut your losses small, you will be able to avoid "being Stuck"

If you cut your losses small, you will be able to avoid "being Stuck"

This is not a buy or sell call, just to remind myself and everyone not to fall in love to downtrending stock no matter how good this company may sound to you.

Friday, September 28, 2018

Starhub, Yangzijiang & CSE Global with Super Trend System

Do you miss out any of these stocks recently ? The Super Trend System works pretty well for these stocks.....

Want to receive more frequent Trading Ideas in your Email or SMS? Open a Free Trading Account with us now! http://bit.ly/1gegCv0.

Wednesday, August 29, 2018

All Time High Stocks Singapore

With current market situation, there are still some stock in Singapore that is trading at all time high.

The characteristic of these stocks are the same if you have noticed it, based on below charts they are showing uptrend.

It might be too high for most of the investor but for trend following strategy, every pull back of the price, it is an opportunity to enter because the trend is obvious! Uptrend.

Uptrend could be ended any time, so far there is no sign of weakness for these stocks.

So, enjoy raiding on the uptrend and do exit when the uptrend has ended. Cheer :)

Want to receive more frequent Trading Ideas in your Email or SMS? Open a Free Trading Account with us now! http://bit.ly/1gegCv0.

The characteristic of these stocks are the same if you have noticed it, based on below charts they are showing uptrend.

It might be too high for most of the investor but for trend following strategy, every pull back of the price, it is an opportunity to enter because the trend is obvious! Uptrend.

Uptrend could be ended any time, so far there is no sign of weakness for these stocks.

So, enjoy raiding on the uptrend and do exit when the uptrend has ended. Cheer :)

Monday, July 16, 2018

Singapore Company Results: The earnings seasons for Q2 2018 is here !

Many people is asking when is the Quarterly Results or Full year result coming out for Keppel Corp, SATS, SIA, UOB, OCBC & etc...

The earnings seasons for Q2 2018 is here, below are the Singapore stock corporate earnings calendar for (Q2 2018)

Source: Bloomberg, SGX.

Information obtained from sources believed to be reliable but the author makes no representations and accepts no responsibility or liability as to its completeness or accuracy.

Click for our latest FREE 30-hours investment seminars

The earnings seasons for Q2 2018 is here, below are the Singapore stock corporate earnings calendar for (Q2 2018)

Information obtained from sources believed to be reliable but the author makes no representations and accepts no responsibility or liability as to its completeness or accuracy.

Click for our latest FREE 30-hours investment seminars

Monday, May 21, 2018

Sembcorp Marine - ready for a big jump?

Sembcorp Marine seems to be a potential stock to move in near term, here are the few observations.

1) Oil price is now above $70, previously Sembcorp Marine and many of the oil related stock suffered big drop due to oil price falling previously. Now that the Oil price is climbing higher, it is time for the oil relate stock to make a comeback.

2) On the technical chart, you see that the price still on a Higher High, Higher Low pattern, this means that it is an Uptrend formation. The good news is, we are now STILL at the base area, the price have yet to surge.

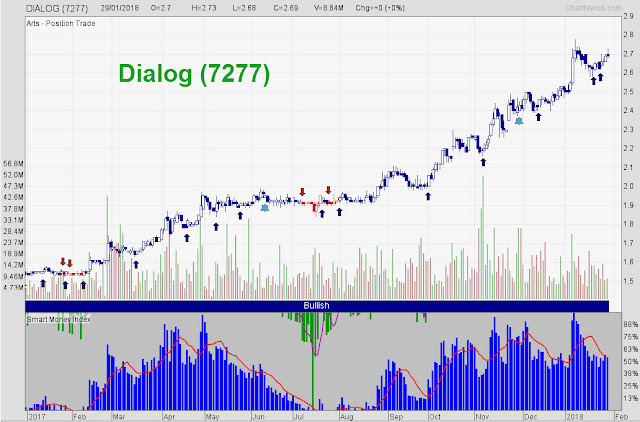

3) It is in the Strong Sector, Oil Producer or Services stock has been strong lately in other market, in Malaysia - Dialog, in Hong Kong - CNOOC 0883.HK & PetroChina 0857.HK is moving up like High speed train.

Your are Invited to our FREE Upcoming Stock Seminar

In this seminar you will learn:

1) How to Select Big Winning Stocks

2) How to Minimize Risk & Maximize Return

3) How to Build to Invest Even if your Capital is Small

4) What Are The Stocks & Sectors We should Monitor Now

5) Step By Step Blueprint to Get Consistent Profit in the Stock Market

6) Common Mistake Investors Made that Cost them a lot of Money

7) Live Stocks Analysis.....

1) Oil price is now above $70, previously Sembcorp Marine and many of the oil related stock suffered big drop due to oil price falling previously. Now that the Oil price is climbing higher, it is time for the oil relate stock to make a comeback.

2) On the technical chart, you see that the price still on a Higher High, Higher Low pattern, this means that it is an Uptrend formation. The good news is, we are now STILL at the base area, the price have yet to surge.

3) It is in the Strong Sector, Oil Producer or Services stock has been strong lately in other market, in Malaysia - Dialog, in Hong Kong - CNOOC 0883.HK & PetroChina 0857.HK is moving up like High speed train.

Your are Invited to our FREE Upcoming Stock Seminar

In this seminar you will learn:

1) How to Select Big Winning Stocks

2) How to Minimize Risk & Maximize Return

3) How to Build to Invest Even if your Capital is Small

4) What Are The Stocks & Sectors We should Monitor Now

5) Step By Step Blueprint to Get Consistent Profit in the Stock Market

6) Common Mistake Investors Made that Cost them a lot of Money

7) Live Stocks Analysis.....

- English Session: 24th MAY (Thu) at 7pm-10pm

- Registration start at 6.30pm

To Register click to Whatsapp Now or

SMS YourName, SeminarDate, YourEmail to 9694 1456

Wednesday, May 16, 2018

How to Sell before Big Sell Down - BestWorld, Hi-P, YZJ [Short Selling Idea]

Congrats if you have followed our previous post on BestWorld, since the blogpost the stock has dropped downward by addition 20% to 1.29 closing today.

If you are watching the market this few day, you will notice that the ELECTRONIC sector is weak right now. Venture is usually the leader of the electronic stock as the price and market cap is bigger than all other electronic stock in Singapore. Do watch out for Hi-P as today's price action seems weak, if it break below 1.37 i think we might see more downside (this stock is available on CFD for shorting)

YZJ SGD also downtrending, today seems that it is showing us a "Fail Rebound", retail investors always like to catch rebound after a steep drop, however many times they will get caught when the rebound fail. This is the setup for shortist, you can short sell on the fail rebound.

Come, let's meet up and discuss more in my up-coming FREE seminar for this month.

In addition you will learn:

1) How to Select Big Winning Stocks

2) How to Minimize Risk & Maximize Return

3) How to Build to Invest Even if your Capital is Small

4) What Are The Stocks & Sectors We should Monitor Now

5) Step By Step Blueprint to Get Consistent Profit in the Stock Market

6) Common Mistake Investors Made that Cost them a lot of Money

7) Live Stocks Analysis.....

If you are watching the market this few day, you will notice that the ELECTRONIC sector is weak right now. Venture is usually the leader of the electronic stock as the price and market cap is bigger than all other electronic stock in Singapore. Do watch out for Hi-P as today's price action seems weak, if it break below 1.37 i think we might see more downside (this stock is available on CFD for shorting)

YZJ SGD also downtrending, today seems that it is showing us a "Fail Rebound", retail investors always like to catch rebound after a steep drop, however many times they will get caught when the rebound fail. This is the setup for shortist, you can short sell on the fail rebound.

Come, let's meet up and discuss more in my up-coming FREE seminar for this month.

In addition you will learn:

1) How to Select Big Winning Stocks

2) How to Minimize Risk & Maximize Return

3) How to Build to Invest Even if your Capital is Small

4) What Are The Stocks & Sectors We should Monitor Now

5) Step By Step Blueprint to Get Consistent Profit in the Stock Market

6) Common Mistake Investors Made that Cost them a lot of Money

7) Live Stocks Analysis.....

- English Session: 17th MAY (Thu) at 7pm-10pm

- Click Link to Register https://www.eventbrite.sg/e/st

i-breaks-3500-barrier-what-are -the-singapore-stocks-to-watch -out-for-now-tickets-460688341 23 - English Session: 24th MAY (Thu) at 7pm-10pm

- Registration start at 6.30pm

- Venue : #34-07, 10 Anson Road, International Plaza, Singapore 079903

To Register click to Whatsapp Now or

SMS YourName, SeminarDate, YourEmail to 9694 1456

Labels:

CFD,

Short and Hedge

Wednesday, April 18, 2018

BestWorld: Exit Signal shown before Big sell down

Spotted Exit Signal yesterday on system before seller were in full force Today to push down the price further although S'pore market was still good.

Protecting your capital is crucial, thankfully the system is able to catch it before it was happened.

The push down of price may not end, next support will be at 1.50 to take note.

Come, let's meet up and discuss more in my up-coming FREE seminar for this month only.

In addition you will learn:

1) How to Select Big Winning Stocks

2) How to Minimize Risk & Maximize Return

3) How to Build to Invest Even if your Capital is Small

4) What Are The Stocks & Sectors We should Monitor Now

5) Step By Step Blueprint to Get Consistent Profit in the Stock Market

6) Common Mistake Investors Made that Cost them a lot of Money

7) Live Stocks Analysis.....

Protecting your capital is crucial, thankfully the system is able to catch it before it was happened.

The push down of price may not end, next support will be at 1.50 to take note.

Many more stocks have shown Exit Signal, is your stock one of them?

Come, let's meet up and discuss more in my up-coming FREE seminar for this month only.

In addition you will learn:

1) How to Select Big Winning Stocks

2) How to Minimize Risk & Maximize Return

3) How to Build to Invest Even if your Capital is Small

4) What Are The Stocks & Sectors We should Monitor Now

5) Step By Step Blueprint to Get Consistent Profit in the Stock Market

6) Common Mistake Investors Made that Cost them a lot of Money

7) Live Stocks Analysis.....

- English Session: 17th MAY (Thu) at 7pm-10pm

- English Session: 24th MAY (Thu) at 7pm-10pm

- Registration start at 6.30pm

- Venue : #34-07, 10 Anson Road, International Plaza, Singapore 079903

To Register click to Whatsapp Now or

SMS YourName, SeminarDate, YourEmail to 9694 1456

Wednesday, April 11, 2018

Market Back from Correction? Uptrend S'pore Stocks in my Watchlist Apr 2018

Many more........

Want to know more stocks from S'pore, Hong Kong, M'sia & US in my Watchlist that have highly potential upside?

Come, let's meet up and discuss more in my up-coming FREE seminar for this month only.

In addition you will learn:

1) How to Select Big Winning Stocks

2) How to Minimize Risk & Maximize Return

3) How to Build to Invest Even if your Capital is Small

4) What Are The Stocks & Sectors We should Monitor Now

5) Step By Step Blueprint to Get Consistent Profit in the Stock Market

6) Common Mistake Investors Made that Cost them a lot of Money

7) Live Stocks Analysis.....

- Chinese Session: 华语讲座 4月18号 (星期3) 傍晚7点到10点

- English Session: 19th Apr (Thu) at 7pm-10pm

- Registration start at 6.30pm

- Venue : #34-07, 10 Anson Road, International Plaza, Singapore 079903

SMS YourName, SeminarDate, YourEmail to 9694 1456

Tuesday, April 3, 2018

2 Most Uptrending Stock Despite Correction

If you

are new to Hong Kong and China Market, we would like to invite you for

following value-added FREE seminar :

Ø Do

you feel that Singapore Stocks are moving too slowly?

Ø Do

you know that Hong Kong & China stocks are much more active as compared to

Singapore stocks?

Ø In

fact, with internet trading, trading overseas markets has become much more

convenient and affordable.

Ø You

can trade Hong Kong and China Stocks using POEMs, and with Promotional

Brokerage Rate

Ø The

one problem that is stopping many people is "FEAR", the fear of

moving to unknown areas.

Ø Most

of the time, it is the lack of knowledge that creates the Fear. The good news

is that this seminar will give you the essential information you need to

survive the volatile market and within the shortest time, you can immediately

apply the things you have learnt.

Ø This

is not a preview class and we do not have a course to sell you at the end of

the session. We are doing this as a service to public investors and to create a

community of successful traders.

In

this session, you will learn:

· The Impact of MSCI inclusion for China Stocks

- Shenzhen Hong Kong Link - What

stock to look at?

- How to get FREE Real time price for

Hong Kong & China Shares

- Where to read Free Research Report

and Stock recommendation from Financial Analysts

- Individual Stock Analysis

- CFD introduction for China A-Shares

& Hong Kong shares

·

To overcome fear of the unknown, you have to acquire

knowledge, to understand the market, risks

involved, and opportunities that lie in trading foreign stocks.

·

This session is for you. Don't let your fear stop you from being

successful in trading.

Event Details:

· Dates: 10 Apr 2018 (Tue)

· Time: 7pm - 9:30pm (Registration starts at 6:30pm)

· Fee: Free Admission

· Venue: Level 6, Presentation Room, Raffles City Tower, 250

North Bridge Road, City Hall MRT (Exit A)

Speaker

Profile: Mr. Andy Yew

Click to Register Now or SMS <Your Name>

<HK10APR> to 9476 8661

Labels:

HKSE,

SuperTrend System

Tuesday, February 6, 2018

How to trade STI index and other World Indices on POEMS using CFD

Do you wish hedge your position when market turn into a bear market or know how to you use lesser capital to take on opportunity in the market? In this article, let me share with you what is Contract for Difference (CFD) all about.

What is Contract for Difference (CFD)?

Contract for difference (CFD) is a contract between two parties, typically described as "buyer" and "seller". Stipulating that the seller will pay to the buyer the difference between the current value of an asset and its value at contract time (If the difference is negative, then the buyer pays instead to the seller).

CFDs are financial derivatives that allow traders to take advantage of prices moving up (long positions) or prices moving down (short positions) on underlying financial instruments.

Margin requirement

As CFD is an Leveraged product hence it operates like a Margin Account. Margin requirement is the minimum capital you have to park in to the account to have an open position.

Financial charges

You essentially become a borrower by as CFD allow you to trade larger stocks or indices using smaller amount of your fund and borrowed fund. Financial charges are charged on daily, mark to market price when market close

Trading STI index on POEMS.How does it look like?

CFD allowed you to long as well as short the STI index,

Long is to buy first, sell later at a higher price to make profit.

Short is to Sell first, buy back later at a lower price to make profit.

STI Bid-Ask Spread is at 3.6 pips. E.g STI bid price is at 2850.6 while ask price is at 2854.2,

Search for Straits Time Index 5SGD in PhillipCFD or Poems 2.0 you will find the contract.

To calculate the value of contract, every 1 point in STI is valued at 5SGD.

If you buy 1 Contract of Straits Time Index 5SGD at 2850, your contract value is $14250, however margin Requirement in CFD is only 5%, hence = 14250*5%= SGD712.5

if you have a 50point Gain in your profit will be 50x5SGD= $250 (gross profit)

So, what will be the COST in trading STI using CFD under POEMS?

Here is the counter detail for STI

Important advantage of trading STI is the COST.

Financial Charges: 3% p.a for long position and 2.5% for short position.

Minimum Margin requirement: 5%

(lower requirement mean lower stuck in fund, opportunity cost is lower)

Commission Charge: 3SGD per transaction

(Stock market minimum commission charge is at 25SGD and yet you are required large amount of fund to invest )

Other World Indices Information:

Click here for other world indices and CFD Equities costs

Click here for other world indices Contract Specifications

Register for our CFD seminar to learn how to benefit from current market condition :

1) CFD for Beginners

2) Technical Analysis for Beginners

2) Technical Analysis for Beginners

Register for our CFD webinar now if you can't wait Now

Labels:

CFD,

Short and Hedge

Monday, January 29, 2018

Subscribe to:

Posts (Atom)